SHARING GOD’S LOVE WITH THE WORLD – TODAY AND TOMORROW

THE IMPOSSIBLE BECOMES POSSIBLE WITH JUST ONE SENTENCE

You Can Remember Marilyn & Sarah Ministries in Your Will or Living Trust

All you have to do in order to help Marilyn & Sarah Ministries be successful for years to come is to write a simple sentence. Sound impossible? It really is as simple as one sentence. By including a gift to Marilyn & Sarah Ministries in your will or living trust, you can support our mission for years to come without giving away any of your assets today.

A BEQUEST IS A POPULAR WAY TO GIVE BECAUSE IT IS:

• Versatile. You can give a specific item, a set amount of money or a percentage of your estate.

• Affordable. Your current income is not affected because the actual giving of your gift occurs

after your lifetime.

• Flexible. You are free to alter your plans or change your mind until your will goes into effect.

HOW IT WORKS

An estate planning attorney can help with your gift to make sure your loved ones will be taken care of first after you’re gone. He or she will include this sentence in a new will or living trust, or add it to existing documents through an amendment called a codicil. You might consider leaving a percentage of what is left of your estate after other beneficiaries have received their share. This way, your gift remains proportionate to the size of your estate, no matter how it fluctuates.

CHECK OUT THIS POTENTIAL SCENARIO

Joe and Kathy both loved Marilyn & Sarah Ministries and decided to include a bequest of $100,000 to us in their will. However, after their 2 children were born, they wanted to make sure that their children’s future was secure financially. After getting legal advice, they decided to change their will to give a percentage of their estate to Marilyn & Sarah Ministries instead of a specific amount. That way Joe and Kathy know that when they die, the people and the ministry they love will both be provided for.

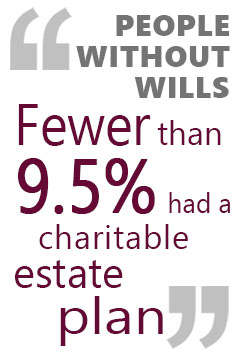

PEOPLE WITHOUT WILLS

PEOPLE WITHOUT WILLS

An article in The Chronicle of Philanthropy discussed a study on people without wills. In the study that tracked a group of Americans over the age of 50, it was found that among those people who donated $500 a year or more to charity, fewer than 9.5% had a charitable estate plan.

YOU ARE UNIQUE! YOUR WILL SHOULD BE UNIQUE TOO!

Your will is one of your most important legal documents; it determines the way your assets will be distributed after you’re gone. It is also a reflection of your life. It shows who and what mattered most to you—and it’s the final gesture by which you’ll be remembered.

You can create a legacy that reflects you at your best – one that cares for your family, loved ones, AND demonstrates your passion for organizations such as Marilyn & Sarah Ministries. With a little planning and expert advice, your will can do these things and more. Here’s how to get started:

STEPS TO CREATING YOUR WILL

1. Consider how you want to provide for children or loved ones in ways that are meaningful to you and to them.

2. Think about the causes that matter to you, such as Marilyn & Sarah Ministries, and how you want to reflect those passions in your will.

3. List all of your major assets.

4. Decide which individuals or organizations you want to receive specific possessions or a share of your assets.

5. Contact an attorney who specializes in estate planning to determine the best way to structure your will or living trust so that it blesses those individuals and organizations you love.

6. Determine who will be your executor.

7. Have your attorney draft your will.

CHECK OUT THIS POTENTIAL SCENARIO

CHECK OUT THIS POTENTIAL SCENARIO

Robert and Carol treasure the financial help they’ve been able to give their children and Marilyn & Sarah Ministries over the years. Now that their kids are grown, Robert and Carol changed their estate plan so it could work harder for the people and causes they love. The couple updated their will to leave stocks and real estate to their kids. And they left Marilyn & Sarah Ministries a $75,000 IRA to be transferred after their death. Because Marilyn & Sarah Ministries is tax-exempt, all of the $75,000 will help support our mission.

If Robert and Carol had left the IRA to their children, approximately $21,000* would have gone to pay federal income taxes—leaving only $54,000 for their family’s use. Robert and Carol are happy knowing they are making the most of their hard-earned money thanks to their updated estate plan.

*Based on an assumption of a 28 percent marginal income tax bracket.

HELP MARILYN & SARAH MINISTRIES and SAVE IN TAXES

See Your Generosity in Action

If you are 70½ years old or older, you can take advantage of a simple way to benefit Marilyn & Sarah Ministries and receive tax benefits in return. You can give up to $100,000 from your IRA directly to a qualified charity such as Marilyn & Sarah Ministries without having to pay income taxes on the money.

WHY CONSIDER THIS GIFT?

• Your gift will be put to use today, allowing you to see the difference your donation is making.

• You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

• If you have not yet taken your required minimum distribution for the year, your IRA charitable rollover gift can satisfy all or part of that requirement.

NEXT STEPS

1. Contact Diane Reiter at 303-887-2154 or dianer@mhmin.org for additional information on bequests or to chat more about the different options for including Marilyn & Sarah Ministries in your will or estate plan.

2. Seek the advice of your financial or legal advisor.

3. If you include Marilyn & Sarah Ministries in your plans, please use our legal name and Federal Tax ID.

Legal Name: Marilyn & Sarah Ministries

Address: 6825 South Galena Street, Suite #300, Centennial, Colorado 80112

Federal Tax ID Number: 81-2619433

The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in examples are for hypothetical purposes only and are subject to change. References to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your results.